How to Create an Dynamic Business Plan for your Startup?

Now that you've made the exciting decision to kickstart and launch your own startup, and you're in the process of crystallizing your vision, whether it's for your internal team or to secure funding from venture capital, a pivotal document that can serve as your North Star is the business plan. In this article, we will delve into the concept of a business plan, discuss the art of crafting a flexible one that can evolve alongside your business, and uncover the substantial advantages that startups can gain from this strategic blueprint.

What is a Business Plan?

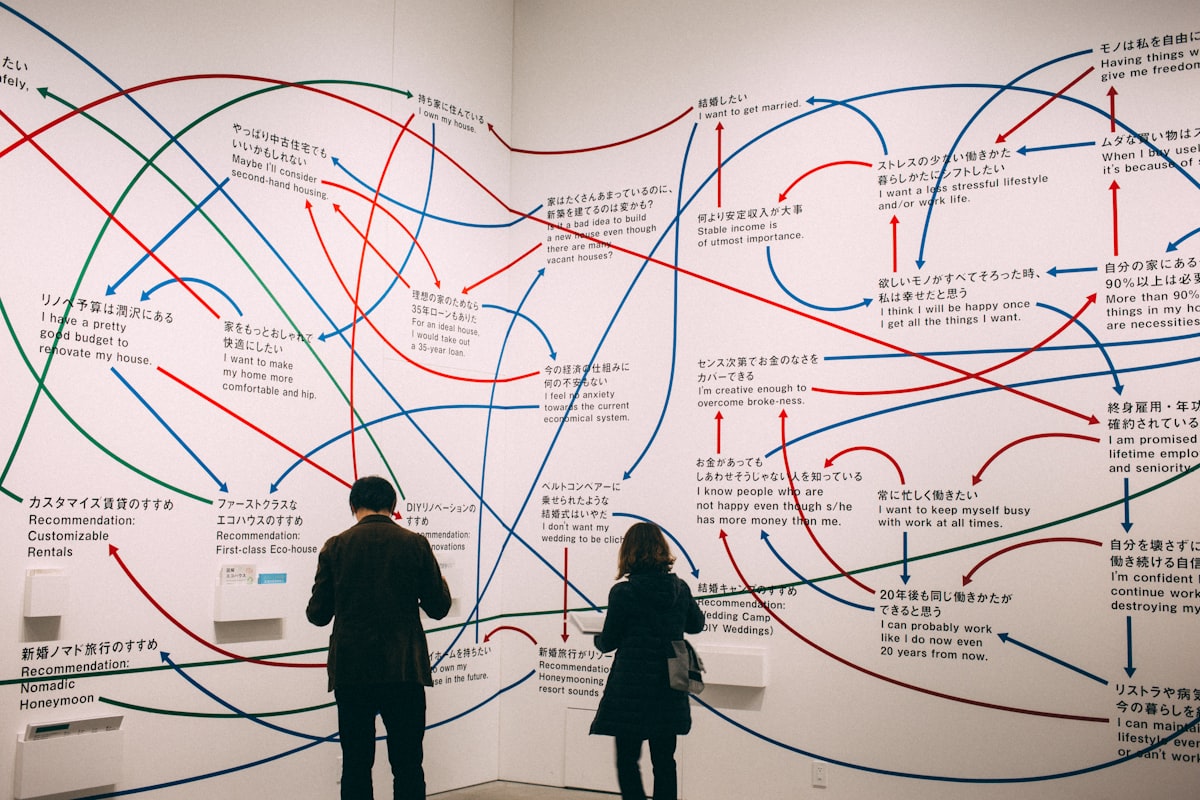

A business plan is your startup's roadmap. It's a comprehensive document that outlines your business goals, strategies, financial projections, and operational details. Think of it as the blueprint for your entrepreneurial dream. But here's the twist: it's not a static document; it's a dynamic one that adapts and grows with your business.

The Dynamic Business Plan

Creating an adaptable business plan is akin to preparing for a marathon rather than a sprint. Your business plan should not be one-and-done exercise; instead, it should be a living, breathing document that evolves over time.

Here's how to make it work for you:

- Start with Clarity: Begin by crystallizing your vision and mission. What problem does your business solve? What's your unique value proposition? Who's your target audience? Clarify these aspects to set the foundation for your plan.

- Set Measurable Goals: Define clear, measurable objectives. Whether it's revenue targets, customer acquisition goals, or product development milestones, having quantifiable targets allows you to track progress and adjust your plan as needed.

- Flexibility Matters: Understand that the business landscape is ever-changing. Your initial assumptions may evolve, and external factors may influence your strategy. Be open to adjustments and revisions

- Regular Updates: Schedule regular reviews of your business plan. Ideally, this should be a monthly or quarterly practice. Evaluate what's working, what's not, and what needs adjustment.

- Financial Projections: Your financial forecasts should reflect the evolving nature of your business. Update your projections to align with your current performance and future expectations.

What to Include in your Business Plan?

A comprehensive business plan typically includes the following sections, each providing essential insights into your startup:

- Executive Summary: Provide a concise overview of your business, highlights its mission, vision, and key objectives. Summarize your products or services, target market, and competitive advantage. Include key financial highlights, such as revenue projections and funding requirements.

- Company Description: Detail your company's history, including when it was founded and the members of the founding team. Explain your company's mission, vision, and values. Describe your legal structure (e.g., LLC, Corporation, Private Limited) and location.

- Market Analysis: Conduct thorough market research to understand your target market's size, demographics, and trends. Analyze your competition, identifying strengths, weaknesses, and opportunities. Highlight any market gaps or unmet needs that your business addresses.

- Products or Services: Describe your offerings in detail, emphasizing their unique features and benefits. Explain how your products or services meet customer needs or solve specific problems.

- Marketing and Sales Strategy: Define your marketing and sales strategies, including channels, tactics, and campaigns.

- Management Team: Provide profiles of key members, highlighting their qualifications and roles. Emphasize the expertise and experience that make your team capable of executing your business plan. Mention any advisory board members or mention who contribute to your success.

- Operational Plan: Outline your day-to-day business operations, including location, facilities, and equipment. Describe your supply chain, production process, and quality control measures. Address any operational challenges or risks and how you plan to mitigate them.

- Financial Projections: Present comprehensive financial forecasts, including income statements, balance sheets, and cash flow statements. Detail revenue projections, expenses, and net income over a specific period (typically three to five years). Include assumptions behind your financial projections, such as sales growth rates and cost estimates.

- Fundraising Plan: Specify the amount of funding you are seeking, and provide a breakdown of how you intend to use the funds. Explain the potential return on investment for investors and the impact on your business's growth. If you've already secured funding, detail the terms of existing investments or loans.

- Exit Strategy: Describe your plan for exiting the business in the future. Common exit strategies include selling the company, merging with another entity, going public (IPO), or passing it on to family members or a management team. Explain the conditions or milestones that would trigger the exit strategy. Discuss the expected outcomes and benefits for investors and stakeholders.

Each section plays a crucial role in conveying your business's vision, strategy, and financial visibility to potential investors, partners, and stakeholders. By providing detailed information in these key sections, you create a roadmap for your startup's growth and a compelling case for its success.

Why have an Dynamic Business Plan for your Startup?

- Clarity of Vision: Putting your business concept on paper forces you to clarify your vision, mission, and strategy. It's a valuable exercise in itself.

- Strategic Decision-Making: A dynamic business plan helps you make informed decisions as you navigate the twists and turns of entrepreneurship. It's your compass during uncertain times.

- Communication Tool: It serves as a communication tool for your team, investors, and stakeholders. It ensures everyone is on the same page and working towards common goals.

- Resources Allocation: Your business plan helps allocate resources effectively. Whether it's budget allocation or human resources, having a plan in place prevents wastage.

- Investor Appeal: For startups seeking funding, an adaptable business plan demonstrates your commitment to success and your ability to adapt to changing circumstances, making you more appealing to investors.

A business plan isn't just a document; it's a strategic companion on your entrepreneurial journey. By creating a dynamic business plan that evolves with your business, you gain clarity, make informed decision, and increase your chances of success. Remember, adaptability is the key to thriving in the ever-changing world of startups.

Have questions or feedback? Say Hi on 𝕏 (formerly Twitter)